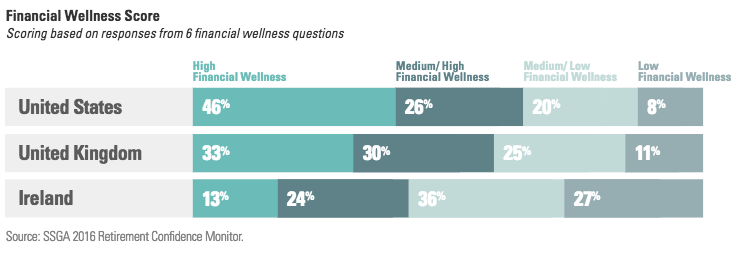

A significantly higher percentage of retirement plan participants in the U.S. scored “high” on a financial wellness test as compared to the UK and Ireland, according to a survey from State Street.

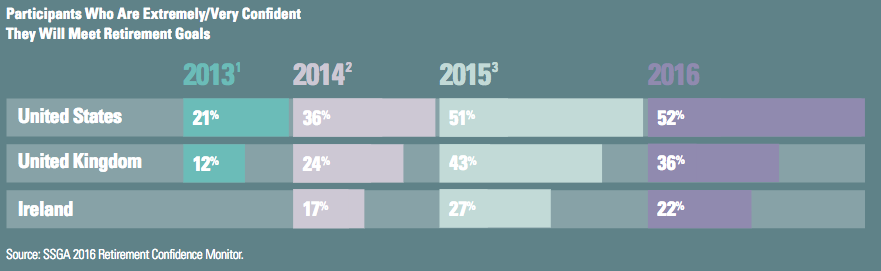

Additionally, since 2013, the percentage of survey respondents who were confident in meeting their retirement goals has more than doubled in the U.S., and tripled in the United Kingdom (although the sentiment peaked in 2015), according to the research.

Unfortunately, Ireland’s working population appears to be struggling with financial literacy and confidence.

A breakdown from State Street:

*The majority of participants feel more financially stable: The majority of US and UK respondents feel more financially stable; however, employees in Ireland feel less in control and sometimes run low on money.

*I rarely or never need to borrow money to make ends meet (75% US, 70%UK, 56% Ireland)

*I can afford a good standard of living for my family (75% US, 72% UK, 54% Ireland)

*I am saving enough for my retirement (52% US, 45% UK, 28% Ireland)

*I don’t feel like I’m in control of my financial situation (16% US, 16% UK, 25% Ireland)

*I don’t feel secure with my employment at my existing firm (15% US, 21% UK, 29% Ireland)

*I sometimes run low on money to spend on basic necessities (15% US, 15% UK, 25% Ireland)

*I have an unmanageable amount of debt compared to income (14% US, 9% UK, 17% Ireland)

*I often have trouble paying my monthly mortgage or rent (7% US, 6% UK, 15% Ireland)

Read the full study here.