Social Security Q&A: Will a Spousal Benefit at 62 Reduce Later Benefits?

Question: My wife and I are 62. She is retired and is entitled to only a few thousand dollars a year. I’m still working and my benefit is the maximum individual benefit. I plan to ...

Social Security Q&A: Why Can’t I Collect Widow’s Benefits if I Collect Retirement?

Question: As a widow, why am I not able to collect any benefit from my deceased spouse’s Social Security if I chose to take the benefit from my Social Security?

Answer: Once you ...

Social Security Q&A: Shouldn’t I Should Take Spousal at 66 and Retirement at 70?

Question: My husband is 64 and I’m 57. He was laid off and took Social Security early at age 62. I am planning to retire at 59 but wait until my full retirement age to start collecting ...

Social Security Q&A: Do I Have to Wait Till 60 to Claim Survivor’s Benefits?

Laurence Kotlikoff is a professor of economics at Boston University who has been answering questions and writing columns about Social Security each week for the past two years on PBS ...

Social Security Q&A: How Will a Survivor’s Benefit Affect My Retirement Benefit at 66?

Laurence Kotlikoff is a professor of economics at Boston University who has been answering questions and writing columns about Social Security each week for the past two years on PBS ...

Social Security Q&A: How Can We Maximize a Lower Earner’s Spousal and Survivor Benefits?

Laurence Kotlikoff is a professor of economics at Boston University who has been answering questions and writing columns about Social Security each week for the past two years on PBS ...

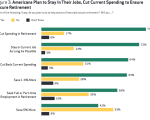

Six Things Americans Are Doing to Ensure a Secure Retirement

The National Institute on Retirement Security released a report last week on the American public’s perception of their retirement prospects.

There were a number of interesting ...

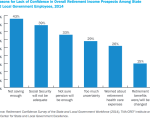

Chart: Reasons For Lack of Retirement Confidence Among Public Workers

Public workers aren’t confident about having enough income and savings to last through retirement. Why? The number one reason is inadequate savings. A significant portion of ...

6 Ways Boomers Can Help Grandkids Afford College

By Gary Foreman, The Dollar Stretcher

Whether it’s for your kids or grandkids, you’ve always believed that a college education was important. So as tuition costs continued ...

Dispelling the Myth: For Many, Retirement Doesn’t Mean Lower Taxes

In a recent column, wealth manager Montgomery Taylor (CPA, CFP) has a simple message for soon-to-be retirees: don’t assume your tax burden will fall when you enter retirement.

Taylor ...