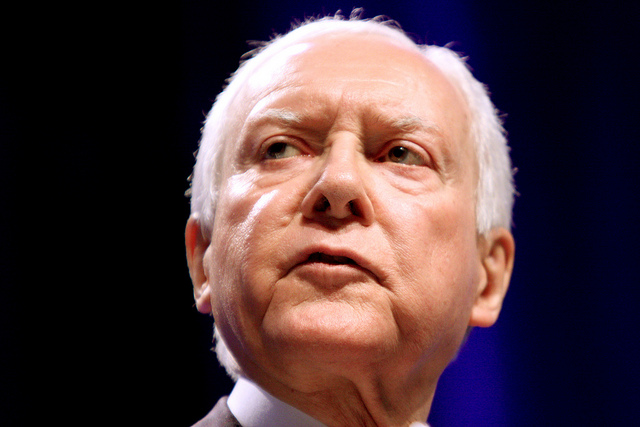

Senator Orrin Hatch [R-Utah] is chairman of the Senate Finance Committee, and thus is a major player in setting the agenda for what issues the chamber will examine this year.

On Tuesday, Hatch laid out the issues that will be occupying the Senate Finance Committee’s attention in the coming months.

Among the issues on tap: introducing incentives to help Americans save for retirement.

From Pensions & Investments:

New retirement savings incentives will be [a] top priority of the Senate Finance Committee, incoming Chairman Orrin Hatch, R-Utah, said Tuesday at the U.S. Chamber of Commerce.

The Finance Committee last week launched five bipartisan working groups to explore tax reform proposals for individuals and businesses, ways to promote savings and investment, infrastructure and community development, and international tax issues. “They are all committed to this process, and I believe it is going to work,” Mr. Hatch said, adding that he expects legislation to be introduced and acted upon later this year.

Hatch will also attempt to re-kindle the momentum behind his SAFE Retirement Act bill. P&I reports:

The committee will also take up Mr. Hatch’s SAFE Retirement Act proposal, which would expand the use of multiple employer plans, allow public defined benefit plans to purchase private annuities, and create a “starter 401(k) plan” for small, private-sector employers.

“I remain convinced that my plan represents the best solution to the growing pension crisis in America,” Mr. Hatch said.

Hatch says the Committee will also take a critical look at Social Security and Medicare. It’s unclear what exactly Hatch has in mind as far as reform proposals go.

You can read more about the SAFE Retirement Act here.

You can read the transcript of Hatch’s full speech here.

Photo by Gage Skidmore via Flickr CC License