A slight majority (52%) of defined-contribution plan participants were “extremely” or “very confident” in meeting their retirement goals, according to a new survey from State Street.

Confidence among U.S. 401k plan participants has improved significantly since 2013, when the number sat at 21%, according to the research.

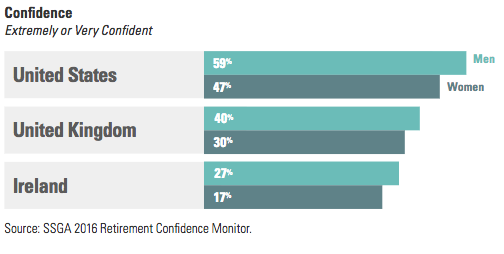

More men were confident than women; additionally, confident rates are higher in the U.S. than in the United Kingdom or Ireland, citizens of which were also surveyed.

In all three countries, women lagged behind men in confidence rates. The study commented:

In all three countries, women lagged behind men in confidence rates. The study commented:

Understanding gender gaps and what to do about them can present a conundrum for plan sponsors, particularly when it comes to retirement and financial matters. Men and women are biologically and demographically different. Men are typically paid more, may exhibit or claim greater confidence, and are less likely to take time away from their career to care for family members. Conversely, women tend to be more risk averse and better long-term investors, and they also have a longer life expectancy.The gender gap is persistent in retirement confidence measures. And the gap is significant — women in the US lag behind their male counterparts by 12 percentage points; those in the UK and Ireland both lag by 10 percentage points.

U.S. participants were also the most satisfied with their employers’ involvement in financial education and wellness. From a press release discussing the study:

US participants are the most satisfied with employer involvement: while all countries showed improvement over 2015 levels, more than half (56 percent) of US respondents are satisfied. Ireland made the greatest stride over the past year, with a 12 percent increase in satisfaction versus 2015.“Employers should view increased satisfaction and stronger financial stability as a sign that retirement readiness is improving,” continued Axsater. “Bringing financial wellness indicators into the picture can help employers focus on additional worries, such as debt management or emergency savings, that may be impacting how employees feel about and prepare for retirement. Seeing the bigger picture can help build a stronger future.”

Read the full report here.