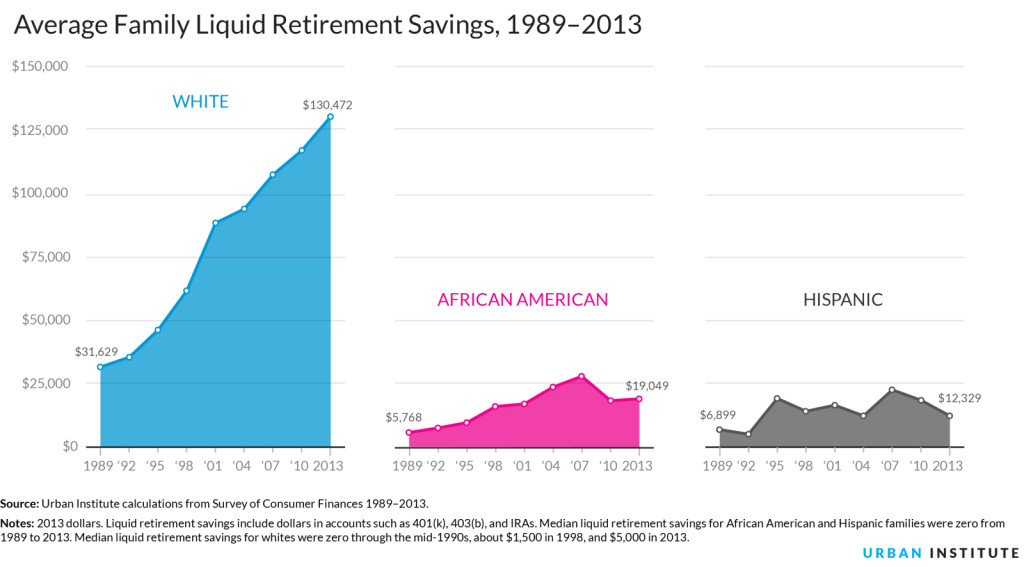

This stark chart comes courtesy of the Urban Institute, and it shows the gap in liquid retirement savings between White, African American and Hispanic families in the United States.

Averages, of course, can be skewed. But it’s important to note that the gap is still present when comparing median savings, as well: According to the Institute’s study, the median white family has $5,000 in liquid retirement savings. The median African-American and Hispanic families have zero.

Why does this gap exist? The Urban Institute tackles that question:

It’s not just income differences; even at the same income level, gaps remain. African American and Hispanic families have slightly less access to retirement saving vehicles and lower participation when they have access.

But lower access and participation isn’t the full story. Hispanic workers are less likely to participate in employer retirement plans than African American workers but have similar average liquid retirement savings.

This suggests that simply having more employers offer retirement plans will not be enough to close the gap, especially if lower-income groups contribute smaller portions of their income to retirement plans and have a greater likelihood of withdrawing money early to cover financial emergencies. Lower-income families may also get lower returns on average if they invest in safer, more short-term assets.

Read the full Urban Institute study on wealth inequality here.