The New Year has ushered in a few tweaks to Social Security – including a COLA, an increase in the taxable earnings cap and more.

What changes are coming? US News explains:

Social Security recipients will receive 1.7 percent bigger payments in 2015, due to the annual cost-of-living adjustment. Most workers will continue to pay 6.2 percent of their earnings into the Social Security system, but the maximum taxable earnings amount will increase next year from $117,000 in 2014 to $118,500 in 2015. The Social Security administration will also mail Social Security statements to workers turning ages 25, 30, 35, 40, 45, 50, 55 and 60 in 2015 who have not created an online account.

More details on the statement mailings, from US News:

The paper statements will be sent to workers ages 25, 30, 35, 40, 45, 50, 55 and 60 who are not registered for online statements or currently receiving benefits. These previously annual mailings to workers were suspended in April 2011 to save money, and the ability to view statements online was added in May 2012.

[…]

Of course, you don’t have to wait for your paper statement to arrive in the mail. Workers age 18 and older can view their Social Security statements online at any time, although you will need to verify your identity by answering questions about personal information to create an online account. “Set up your access like any other financial site, and check your Social Security data any time you want,” says Andy Landis, author of “Social Security: The Inside Story.” “I even have the SSA mobile app, just like mobile banking.”

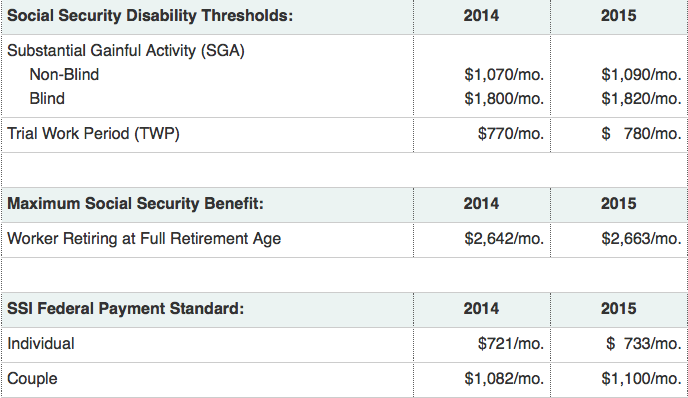

A few other changes:

See the full roster of 2015 changes here.

Photo Credit: Preserved Light Photograph via Flickr Creative Commons License