The vast majority of working Americans pay a portion of their paycheck toward the Social Security Administration. But where does that money actually go?

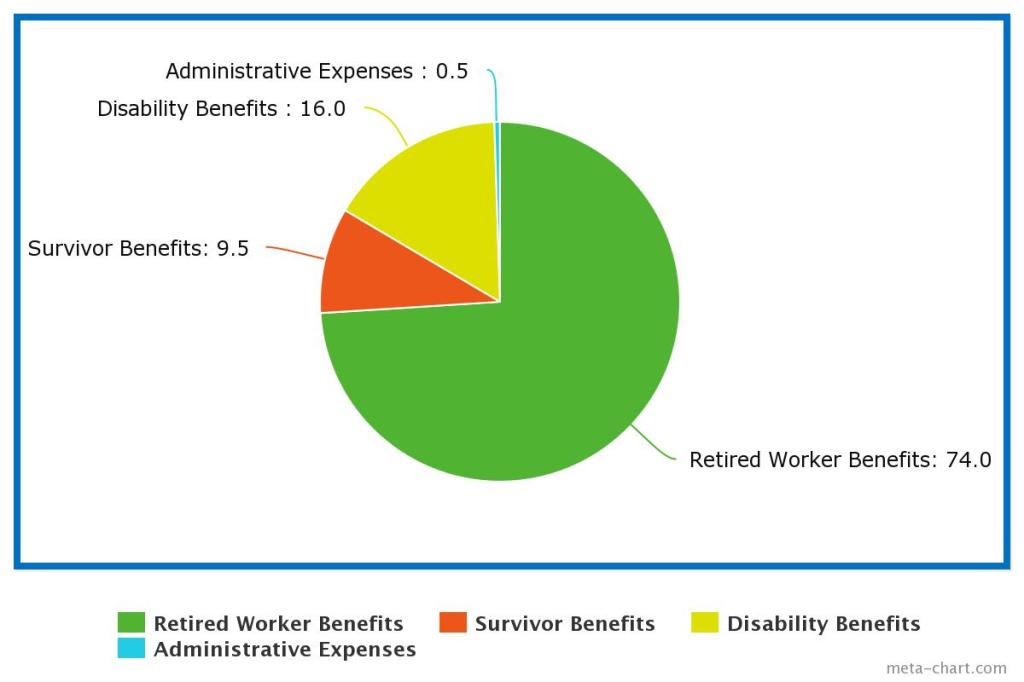

Motley Fool breaks down the four distinct areas to which your tax money flows, and the percentage of money that goes to each area:

– Retired worker benefits (74%): The bulk of Social Security payments goes toward taking care of retired workers. The SSA’s 2013 figures show that $0.74 of every Social Security tax dollar spent will go toward retiree benefit disbursements. In order to qualify for retiree benefits you simply have to earn 40 “credits.” One credit is currently equal to $1,200 in earnings, and you can earn four credits per year. Therefore, if you’ve earned at least $4,800 per year for at least 10 years, then you qualify. The SSA will then average your highest-earning 35 years to calculate your benefit payment.

– Survivor benefits (10%): An additional $0.10 of every tax dollar is divvied out monthly to survivors of deceased workers. These benefits help supplement income for spouses and children of deceased workers, which is critical, as the SSA predicts that one in eight adults in their 20s today will die before reaching their full retirement age.

– Disability benefits (16%): The remaining benefit payout goes to those who are disabled and are unable to do the same type of work they had been doing or entering a new field of work. Because disabilities can occur before reaching normal working credit eligibility the SSA has developed a “duration of work” test to allow eligible Americans younger than age 62 to qualify.

– Administrative expenses (less than 1%): Lastly, the Social Security Trust Funds need to pay SSA employees as well as cover the cost of the infrastructure that allows Social Security to operate. Based on SSA literature it’s among the most cost-efficient government programs, costing less than one penny for each Social Security tax dollar collected.

Employees and employers are both taxed at a 6.2 percent rate.