Demand for senior housing may be overstated due to a misconception about the age threshold at which seniors begin using service-enriched housing, according to a new report from Rockwood Pacific and Senior Housing Analytics.

McKnight’s Senior Living has the cliffnotes:

To forecast demand for seniors housing accurately, the senior living industry should look at those aged at least 80 years rather than those aged at least 75 years, Rockwood Pacific Principal Francesco “Frank” Rockwood told McKnight’s Senior Living. That’s what his company and affiliate Senior Housing Analytics did in their most recent demand estimates calculated for the American Seniors Housing Association, he said.

“The market is expected to grow more slowly through 2025 then you might be led to believe by looking at the world through the view of the 75+ population,” Rockwood said.

That’s because older adults aren’t moving into independent living, assisted living or memory care communities, or skilled nursing centers, until they are around 80 years old, the white paper noted, citing statistics from the Centers for Disease Control and Prevention, the Center for Retirement Research at Boston College and a previous study co-sponsored by several senior living industry associations.

Removing those aged 75 to 79 from the equation makes it appear as if 8 million fewer potential users of senior living exist — a 40% reduction, the white paper stated, but “to a large extent, these 8 million older adults were never customers.”

If you want to get technical, here’s a key excerpt from the report:

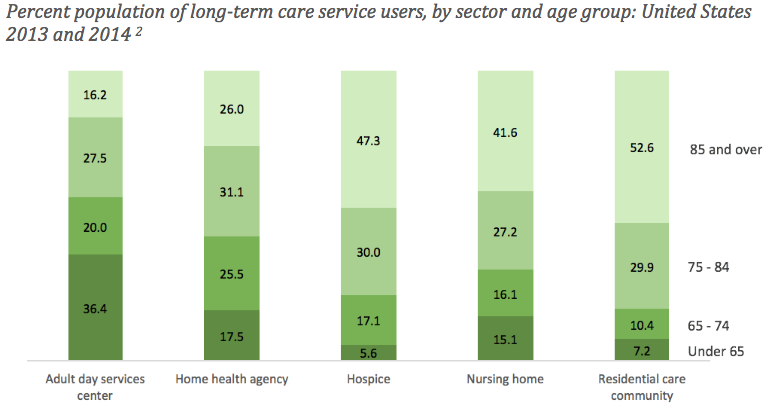

Center for Disease Control and Prevention (CDC) data indicates that a majority of residential care community residents are over age 85.

The CDC data is consistent with the findings of a study sponsored by the Center for Retirement Research at Boston College in 2012, which found that the median age of entry for independent living and assisted living was age 83.7 and 84.8 respectively. A prior study co-sponsored by several major industry associations including ASHA, NIC and LeadingAge provided a breakout of age of residents in assisted living by quartiles; with the youngest quartile age of 82.6. So even moving beyond median figures, the case for reducing the focus on the 75-79 age cohort is strong. And yet, much of the industry analysis, including our own, has been grounded in the age 75+ cohort.

As a rule of thumb, the 75+ v. 80+ benchmark choice implies that benchmark penetration ratios should rise by about 50% and growth rates over the next decade should decline by about a third. Interestingly, the implications of the 75+ v. 80+ benchmark choice on future growth rates vary, with locations that have high forecasted growth in their 75+ age cohort expected to experience relatively high growth in the 80+ age cohorts.Conversely, and worthy of special attention, relatively slow growing markets may be even more slow growing than currently recognized. Accordingly, in light of increases in supply growth, investors, developers and operators should be particularly careful about expanding supply in slower growing markets.