Over 400,000 seniors are supplementing their incomes by working in the “gig economy”, according to a new study from the JPMorgan Chase Institute.

The gig economy includes ride-sharing gigs like Uber and freelance work platforms like UpWork and TaskRabbit.

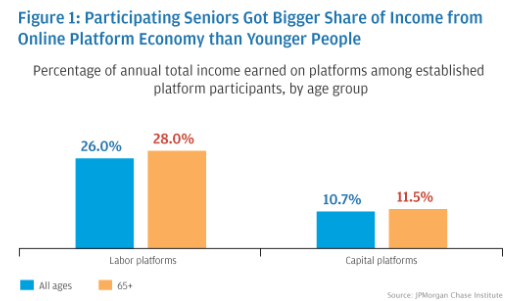

Although seniors get 45% of their income from Social Security, they are increasingly turning to the gig economy to supplement their income.

From the report:

This new source of income is certainly welcome for many seniors. At Uber, the majority of drivers report that working for the platform improves their income and financial security. Among all Uber drivers, 24% were 50 years or older and 3% were formerly retired, according to a report last year. Furthermore, the American Association of Retired Persons (AARP) has partnered with Uber to enlist more seniors as drivers. According to the New York Times, nearly 600 new senior drivers were enlisted into Uber by early this year through this program. Likewise, other platforms are finding seniors to be great providers. At home-rental platform AirBnB, people aged 60+ are the fastest-growing and best-reviewed age group on the platform.

But more income leads to more volatility for seniors, according to the report:

According to our data, seniors (those 65 years and older) see their income swing by 20% month-to-month on average. Although this is lower than the 43% average monthly income volatility for younger age groups, it is still considerable. Furthermore, those seniors who are in the workforce are likely experiencing much higher than 20% monthly income volatility, as our data show that labor income is 10 times more volatile than social security income.

This variation in income can be a real problem for many working seniors, especially those who live on a strict budget. Income volatility matters because it is hard to manage and because many seniors lack the financial buffer necessary to weather the volatility.

The combination of volatile income and a limited financial buffer can create hardship for seniors when trying to meet regular expenses, and even more hardship when expenses fluctuate. Medical costs are a prime example of a large and often unpredictable expense for seniors. Although seniors tend to gradually shrink their expenditures across nearly all spending categories as they age (by about 25-30% overall during their late 60s, 70s and 80s), healthcare is the one category where spending tends to rise as people age.

The report comments on the implications of the findings for policy-makers and non-profits:

Policies could be designed to smooth out spikes and dips in income over time, enabling seniors (and others) to better manage their budgets. Moreover, better financial education or new financial products could help seniors to anticipate income fluctuations and plan accordingly.

Going forward, policymakers should pay close attention to this phenomenon and consider how to protect and promote the welfare of all platform workers, including seniors. Social safety net programs like unemployment insurance, workplace benefits, and other protections available to most workers under the law are often inaccessible to platform workers, who are commonly classified as independent contractors. Additionally, platform employment opportunities do not typically withhold taxes from take-home pay. As a result, more low – to middle-income seniors might find that they have to make tax payments and might even owe tax underpayment penalties. Innovations to predict and automatically withhold or save taxes owed could help these workers avoid owing significant payments at tax time.