What are senior housing investors looking for?

This was one of the questions raised at the 2016 NIC Fall Conference, and it was further touched on in an article this week published by the National Real Estate Investor.

One interesting nugget from the NREI article describes why investment firms are eyeing senior living facilities that offer a tiered approach to the aging process: continuing care retirement communities.

From NREI:

One common theme threading together the investment strategies of various firms is the emphasis on continuum of care. From an investment perspective, continuing care retirement communities (CCRCs) that offer care from independent living to assisted living to acute care are more stable assets, sources say.

This continuum of care is “an essential foundation of the industry,” according to [Mel] Gamzon [of Senior Housing Global Advisors], valuable to consumers who don’t have to move as they age and valuable to owners/investors via reduced turnover rates.

ROC, for instance, prefers to invest in CCRCs offering two of the three major care services, such as independent living/assisted living or assisted living/memory care, says Chapin. “We want residents to be sticky to the property, catch them in the early stage of independence and care for them through their life,” he notes.

Memory care isn’t as popular. From the same article:

Many investors are currently avoiding memory care facilities. Some say the investment is simply too narrowly focused to deliver satisfying returns, while others cite overbuilding in the sub-sector.

In certain markets, stand-alone memory care facilities compete with assisted living properties that also feature memory care units, according to [David] Hegarty, [President of Seniors Housing Properties Trust].

“It really comes down to an understanding of the specific micro-market, and specifically, existing supply, and more importantly, barriers to entry for new entrants,” adds Gordon [of Harrison Street Real Estate Capital]. “These communities are very volatile from an operational standpoint, due to their size and average length of stay, and when you layer [in] new competition, occupancy, rates and expenses can take wild swings.”

The point on memory care is backed up by data released earlier this year.

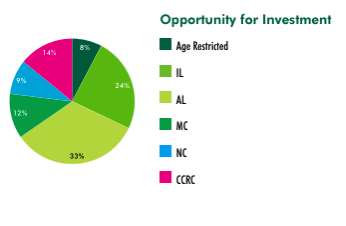

Back in February, CBRE released its Senior Housing Investor Survey. The firm polled investors on areas of senior living in which they see the biggest opportunities; memory care came in last, with just 12% of the vote. See the chart below:

Assisted living facilities ranked #1, as a third of investors saw opportunities for investment there.

Continuing care communities placed third.